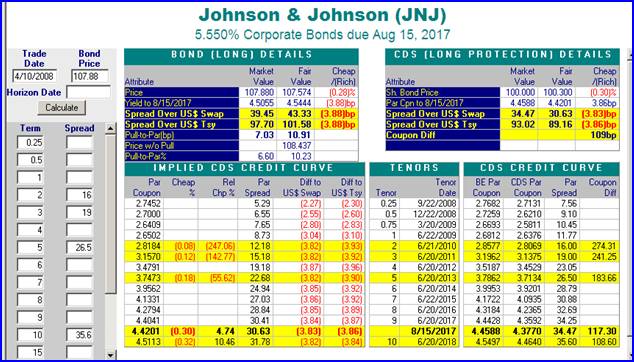

The Pricing of Credit Default Swaps During Distress in: IMF Working Papers Volume 2006 Issue 254 (2006)

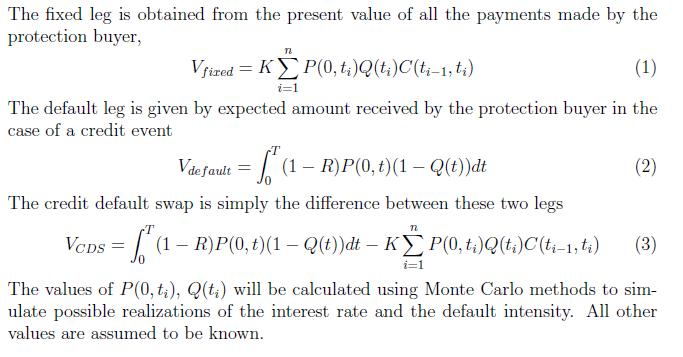

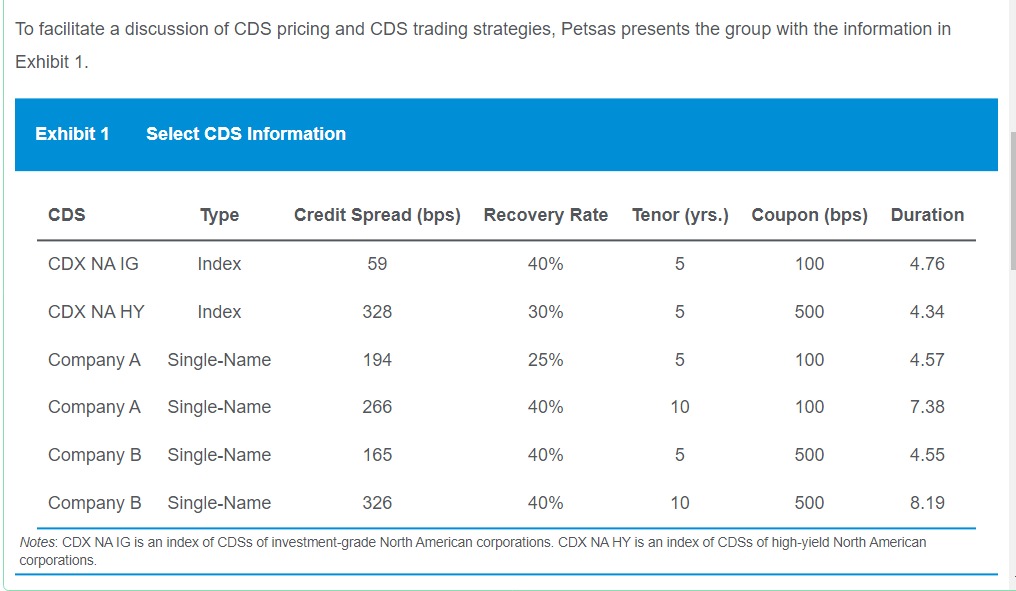

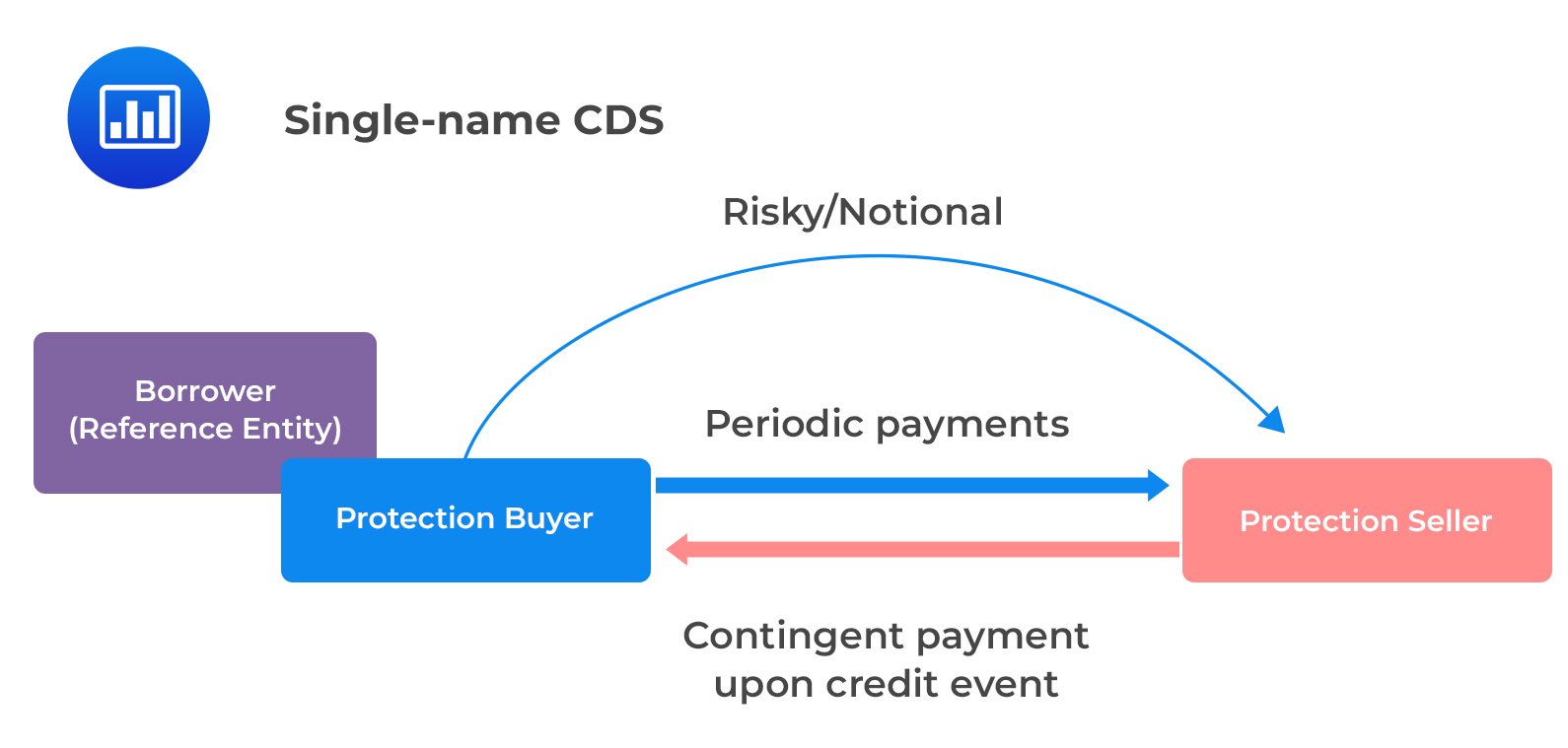

1 Credit Swaps Credit Default Swaps. 2 Generic Credit Default Swap: Definition In a standard credit default swap (CDS), a counterparty buys protection. - ppt download

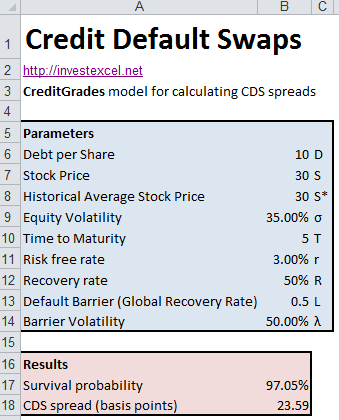

CDS in Python; Extracting Israel Probability of Default implied by Israel 5 Years CDS Spreads | by Roi Polanitzer | Medium